Human Life Value

Greetings,

We hope you found our previous post on the Pradhan Mantri Vaya

Vandana Yojana both useful and informative. If you haven’t had a chance to read

it yet, we’ve put it here so you don’t miss out.

While

the Mesopotamian shekel, the oldest known form of currency, was first used to

trade over 5,000 years ago, it wasn’t till the 1920s that Dr. Solomon S Huebner

managed to calculate what a person’s life is worth. Yes, the process of buying

and selling human beings probably predates our earliest historical records, but

what we’re talking about here is human life value in the context of insurance

coverage. Human Life Value or HLV is an economic theory to put a monetary value

on a human’s life in order to select appropriate life coverage.

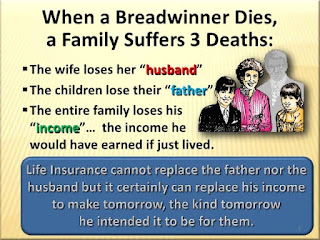

This

is quite simply the process of calculating the total economic loss caused to a

person’s next of kin, which comes in addition to the obvious mental and

emotional trauma that comes with a death in the family. While you can’t put a

price tag on the latter and only time can heal such wounds, it’s the economic

loss that we are interested in putting a price tag on. It may sound

disconcerting at first to have to assign a monetary value to a person’s life,

but the reality is that without such preparedness, grief would undoubtedly be

accompanied by financial troubles as well.

This

is probably why Dr. Solomon S Huebner talked extensively about developing a

sense of responsibility among the general public and in particular, doing away

with the myth that a person’s responsibility to his family is limited to his

time in this world. Additionally, Dr. Huebner looked at any such shirking of

responsibilities as a “crime of not insuring,” and even encouraged a “finger of

scorn” to be pointed at anyone who was not interested in securing the future

for their dependents.

Humans

are social beings who depend on each other for strength and support. When you

talk about Human Life Value, it’s basically the current, future, and potential

financial support that you create for those who depend on you. This is done by

taking into account a number of factors like your present age, what age you

plan to retire at, annual income, employment benefits, and more. When you

calculate all the variables and finally boil it down to one number, what you

get is the final amount required to ensure that your death won’t affect the

people you love financially.

Image Source : https://www.slideshare.net

Now

ideally, you don’t want your dependents to have to depend on your life

insurance coverage, but rather on the interest which is generated from the deposit of the insured amount. So while a simple way to

calculate Human Life Value is obviously to calculate your monthly income from

today till the time you retire, we’re going to look at four different levels of

life insurance coverage.

1. Minimum level: The minimum level is where you cover yourself for up to 100

times of your monthly net income. For example, a man with a monthly income of

Rs. 100,000 insures himself for 1 crore, which is 100 times his monthly income.

This means his dependent can put this in a savings account at a 6% interest

rate to earn Rs. 50,000 a month, which is 50% of his monthly income.

2. Adjustable level:

In the Adjustable level you cover yourself for 150 times your monthly net

income so the same 6% return on deposit would generate 75% of your monthly

income.

3. Comfort level: The

comfort level is where you get covered for 200 times of your net monthly income

so, in case of any eventuality, your spouse will get the same amount as you were contributing to the family.

4. Considering future

inflation: It is always wise to take into account future inflation and in such

a situation it is recommended to cover yourself for 300 times of your monthly

income so that your family receives 150% of your monthly income in the event of

an unfortunate circumstance.

Comments

Post a Comment