Human Life Value

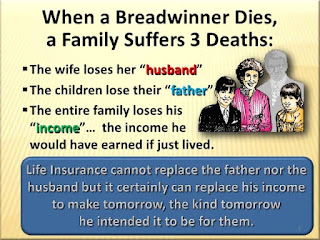

Greetings, We hope you found our previous post on the Pradhan Mantri Vaya Vandana Yojana both useful and informative. If you haven’t had a chance to read it yet, we’ve put it here so you don’t miss out. While the Mesopotamian shekel, the oldest known form of currency, was first used to trade over 5,000 years ago, it wasn’t till the 1920s that Dr. Solomon S Huebner managed to calculate what a person’s life is worth. Yes, the process of buying and selling human beings probably predates our earliest historical records, but what we’re talking about here is human life value in the context of insurance coverage. Human Life Value or HLV is an economic theory to put a monetary value on a human’s life in order to select appropriate life coverage. This is quite simply the process of calculating the total economic loss caused to a person’s next of kin, which comes in addition to the obvious mental and emotional trauma that comes with a death in the family. While you can’t put a pric