How to Build Your Wealth Management Portfolio

When it comes to wealth management,

it's hard to overlook the importance of a solid foundation. If you are

planning to raise a multistoried structure that you want to outlive a few

generations, then you need to ensure that the foundation on which you build

your dreams is strong enough to shoulder your empire against all unexpected

calamities. Building our wealth management portfolio is no different than this.

It should be able to withstand the economic uncertainties influenced by the

volatility in domestic & international stock market, global economic

slowdown & recession.

Now that we know the importance of a

strong foundation for a long-standing wealth portfolio, you have already

started to wonder how to achieve it. So, what is the best investment plan?

Unfortunately, there is no one stop solution for all your investment needs.

But, you can have one customized with a perfect balance of the available

investment opportunities.

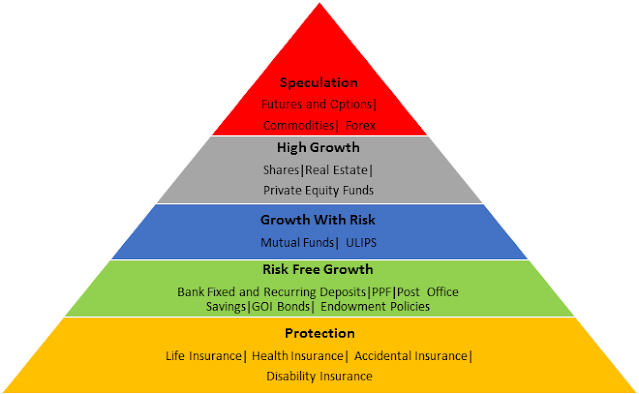

PYRAMID:

The pyramids of Egypt are known for

their unique structure and their longevity. These ancient architectures stand

strong for more than 4000 years now. Of course, they did not achieve this

easily. A lot of time and effort were involved before they finally reached the

pyramid structure – The shape of the pyramid is one of the most vital reasons

for its ability to preserve the mummies for such long periods.

You can build a reliable investment

portfolio that will transfer your wealth to the next generations if you design

it like a pyramid. A structure that we can call - A Financial Pyramid.

Let us see the five layers of the

financial pyramid. While, we do not want to address the products per say, we

will however, cover the concepts to be followed.

Financial Pyramid constructed Bottom

up. As we know, the ground rule for a healthier building, a strong

foundation is the key. As the bottom most layer of the financial pyramid is the

base on which your financial empire is built, it is of vital importance to lay

a super strong foundation. This can be achieved by protecting your investment

source.

PROTECTION - We need to first protect our future income,

how do we do that, by taking proper Life, Health, Accidental & Disability

insurance cover. The three most popular global methods to identify the

appropriate insurance cover are as follows:

- Human Life Value

- Capital Need Analysis

- Net worth method

We will look into each of these in

detail in our next article.

The next layer in the financial

pyramid is RISK FREE GROWTH, After taking adequate insurance

cover, As the saying comes from the "Richest man in the Babylon",

Thus it is wise that we must first secure small amounts and learn to protect

them before the GOD and entrust us with LARGER. Everyone is tempted by

opportunities where we can make huge profits by investing. Our friends and

relatives are eagerly investing and urge us to take the same path as theirs.

The first principle on investing is Capital Security. The penalty

of risk is probable LOSS. The following are some of the prominent risk-free

growth investment opportunities available in India.

· Bank

Fixed Deposit & Recurring Deposit

· Public

Provident Fund

· Post

Office Savings

· Endowment

type life insurance policies

· Govt of India Bonds

The third layer of the Financial Pyramid is Growth Risk which is of medium risk. I have listed below a few investment opportunities that will get you a decent return of over 10% - 12% with lower probability of a loss.

- Mutual Funds

- ULIPS

- Shares

- Real Estate

- Art

- Private Equity Funding

The top layer of the Financial Pyramid is Speculation As the name indicates, it is a super risk asset class which offers tremendous potential for profit and loss equally. The following are a few investments to name in this category:

- Futures & Options

- Commodities

- Forex

As we are now familiar with the financial pyramid structure and the various products associated with it, here is an overview of the risk and return distribution of various product in the financial pyramid structure .

With that concludes the layers of the

Financial pyramid. You can achieve a healthier financial portfolio that can

save you from global and domestic financial instability as you master these

concepts.

We will meet again with another useful financial subject soon. You can also let us know about any specific area of finance that you would like to get familiar with so that we can assist you further.

சிறந்த பதிவு.

ReplyDeleteAre you looking for a loan to finance your project at the rate of 2% in return or Home loan or car loan then Mr Pedro loan offer will be good for you since they offered international loan to individual or company looking for way to expand their business or personal loan because Mr pedro and his working company helped me finance my business at the rate of 2% in return in which I will be closing my loan next year on this date, I really hope to order another loan from them because they are genuine loan company with a very good interest.

ReplyDeleteContact Mr Pedro loan offer on E-Mail: pedroloanss@gmail.com whatsapp: +1-863-231-0632